- By Dan Veaner

- Opinions

Print

Print

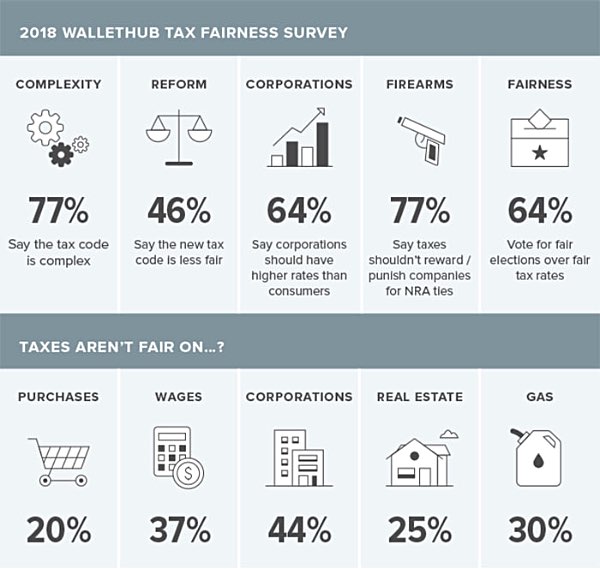

With just over two weeks to go before taxes are due, most of us are feeling put upon as we spend over 6 billion hours a year complying with the tax code. We look at that shoe box with a combination of hope and resentment, and struggle so much to understand all those little boxes that over 50% of us give up and pay accountants to do it for us. A Wallethub survey released Wednesday says most American taxpayers think the tax code is too complex, and complains that the new tax code is less fair than the old one.

I resent taxes at least four times a year. In August when school taxes are collected, in January when town and county taxes are due, in March when they get your business taxes, and, of course, April when personal income taxes are due. Part of it is the money itself. Part of it is the number of hours you have to spend accumulating your receipts and tax information, even if you do use an accountant, and part of it is what we get for the tax money.

The survey says 77% of Americans think taxes are too complicated, and almost half said the new tax reform isn't fair.

Recent Wallethub analyses show that New York State has the 10th highest property taxes (tied with Rhode Island), and that New York is the 3rd state least affected by the new federal income tax rules. And a 2017 analysis shows New York has the highest income tax burden of all the other states. And our state ranks among the highest sales tax collectors. So why is New York rated 46 out of 50 for bet rate of return for tax dollars?

I can't help feeling that we are not getting the right amount of bang for our $3.982 trillion bucks. If I had to list taxes in order of resentment from worst to best, I'd say state, communications taxes and fees, payroll taxes, county, federal, sales, school, town, library, fire. Did I forget any? Trying to remember them all is so taxing... That's before considering how we a taxed on the same money more than once. The taxes eat away at our wallets. They feast on our wallets.

Are taxes out of control? I don't complain about the Federal highways when I take a trip (well, I do complain about perennial road construction, even though it is the cause of my not complaining about the highways). I am happy with our local roads. I am happy for the armed services, and Social Security. Lately I have been ecstatic with Medicare.

That's the point - it is obvious that taxes are a necessity to pay for things we need as a country, a state, and a community. Most of us want a lot of those things, so it is not unreasonable to pay for them. However, as our local politicians are fond of repeating, our elected officials are not spending their own money. They're spending ours. So they should be conservative about how they spend it, and think in terms of getting the most benefit out of every dollar.

That is my biggest beef with New York. Being the 5th worst state at getting the best bang for buck is not impressive. At a planning board meeting the other night members of the board lamented that the Department of Environmental Concervation is so underfunded they don't have staff to do what they need to do. New York likes to tell locals what they have to do, but the state doesn't like paying to enforce those things or make them happen. For years the State withheld aid to school districts while at the same time limiting their ability to set their own tax levies. if you are going to have rules you should either fund them or have fewer rules. You don't buy a Lexus when you can only afford a Corolla.

You have to think that if the state could spend more efficiently it could shed its reputation for its taxes being out of control. The so-called pork projects the federal government seems to attach to every bill it passes are another case in point. Although, on the state pork level, I have to say I am thrilled when state funding goes to our library and airport and schools.

I recently spoke to an accountant about an aging relative whose income has been reduced exclusively to Social Security payments. It turns out my relative has such a low income that income tax filing is a thing of the past. If you are looking for a silver lining to being poor, there it is!

v14i12