- By -Staff

- Opinions

Print

Print  We need symbolic tax hope. We're not going to get actual tax relief, but symbolic relief helps a little. Kind of. That's why school officials shouldn't try to lump their tax rise with the town's tax drop. The latter felt good, at least on a symbolic level. Dollars... not so much.

We need symbolic tax hope. We're not going to get actual tax relief, but symbolic relief helps a little. Kind of. That's why school officials shouldn't try to lump their tax rise with the town's tax drop. The latter felt good, at least on a symbolic level. Dollars... not so much.Last Monday the Lansing school superintendent floated a number of ways the school board might characterize an approximate 6% rise in the school tax rate to the public. He said one way of looking at it is that when other local taxing authorities are in trouble the schools try to take that into consideration when developing their budget, so why not look at it the other way around?

That would mean that a projected school tax rate rise of 5.95% combined with the town's 15% reduction would only come to a 4.3% tax rate rise. It is more palatable than a nearly 6% rise. But I think that's a dangerous road to take.

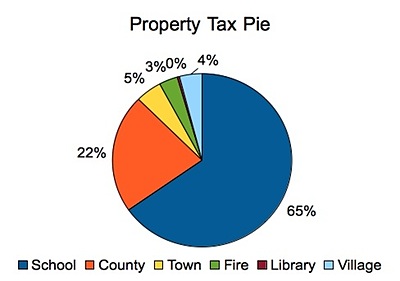

First of all, there are five property taxing authorities in Lansing, not two. The biggest two are the school district and the county. Significantly smaller are the town, fire district and library. The number is less reassuring when you add the rise in the county tax. A projected rise in the library tax and the couple of cent drop in the fire tax don't have real statistical impact.

School taxes account for the largest slice of our property tax pie. Based on 2012 town, fire, and county taxes and 2011 school and library tax rates.

School taxes account for the largest slice of our property tax pie. Based on 2012 town, fire, and county taxes and 2011 school and library tax rates.The 15% tax drop in the town is symbolically huge, especially in today's economy. But it only comes to $24.34 for a $100,000 house. Twenty-five bucks is only a moderate dinner for one these days. The projected rise in the school tax amounts to $114 for a $100,000 house. Does that mean we'll really be paying only $89 more? Sure, if you choose to look at it that way.

But that depiction takes away the symbolic significance of the Town's tax drop. 15% is a significant drop for any municipality. The great feeling you get from a municipality that is trying to be responsible and is able to give back to the community is valuable, especially in these trying times, even though the reality is that it's not a lot of cash.

Merging the rise in the school tax rate with the drop in the town rate takes that symbolic victory away. Instead of saying we are paying less and still getting great services we say we are paying less than we would have paid. That's still more, and because of proposed cuts to the school budget, getting less for that more.

Property taxpayers aren't getting much satisfaction these days as they struggle to bear the burden that never seems to get lighter in New York State. So we have to take what we can get. I think the symbolism of the town tax drop is too important to mess with. We have to feel good about something.

Fully half of the projected school tax rise comes from reduced income from the AES Cayuga power plant. People understand that the plant's value has been tanking. The school sets the amount of money it needs to operate. When one taxpayer pays less, all the other taxpayers have to pay more to make up the loss.

The Town also suffers a loss from the AES PILOT, but is is a proportionally smaller loss in real dollars than it is to the school district or the county. Despite that they were able to make a statistically significant cut.

The power plant situation is a disaster for the community, and the upcoming tax rise is the most significant manifestation of that disaster. Nobody is going to like that, but I think most people will understand it. I don't want them to, but I don't see how they can avoid it.

So I hope the School District will portray the tax rise on its merits and not mess with the little glimmer of optimism and hope we got from what the Town did. In these trying economic times we need any glimmer we can get.

v8i9