- By Dan Veaner

- News

Print

Print

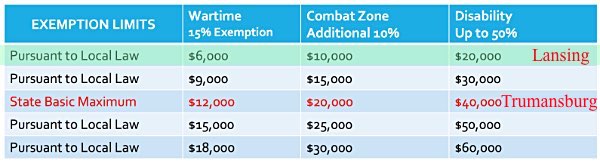

The Lansing Board Of Education Approved a veterans tax exemption Monday in a split 4-3 vote, becoming the second school district in Tompkins County to offer such a benefit. While a property tax break for veterans has been discussed before, this is the first time Lansing has extended the benefit. Wartime veterans will receive an exemption of 15% capped at $6,000. Combat zone vets will receive an additional 10%, capped at $10,000, and disabled veterans may receive as much as 50% with a $20,000 cap.

"I want to be very clear, and I think I speak for this whole board... there is nobody here who doesn't thank you for the service that you've given us," said School Board President Christine Iacobucci after Monday's public hearing on the exemption. "We honor you and we're so glad that you're here talking to us. But what I think I hear is the Governor put us in front of you and said 'ask these people for the money' instead of forking over the money from the State. That's the issue I think we're going to be grappling with when we vote on it."

That summarized the dilemma for board members. On the one hand they want to honor those who have put their lives on the line to protect our way of life, but on the other hand board members are keenly aware that school taxes are already too high for some Lansing residents. Some argue that on top of unfunded state mandates, Albany puts more pressure on school districts to fund a benefit the state itself should pay for, especially if it cares enough to advocate for the benefit. Non-veterans will have to foot the bill in order to provide the exemptions for veterans.

Lansing resident and veteran Jase Base said that the Veterans Administration (VA) counsels veterans to sign up for local tax exemptions.

"When people come in and ask about college benefits or other benefits for veterans with disabilities, they first say 'Are you getting this benefit?" he said. "It's ridiculously easy to apply for and you should be getting it, because if you're not getting it you're losing out on that opportunity."

Taxing authorities in New York that want to extend property tax benefits to veterans may choose the state recommended maximums, or vote greater or lesses levels. Lansing voted for lower maximums than the State recommends. The Trumansburg Central School District extends the State recommended levels.

Taxing authorities in New York that want to extend property tax benefits to veterans may choose the state recommended maximums, or vote greater or lesses levels. Lansing voted for lower maximums than the State recommends. The Trumansburg Central School District extends the State recommended levels.Within Tompkins County, taxing authorites that offer a veterans exemption are the County itself ($15,000/$25,000/$50,000), the Towns of Lansing, Caroline, Danby, Dryden, Enfield, Groton, Ithaca, Newfield, Ulysses, and the Villages of Freeville, Groton, Cayuga Heights, Lansing, Trumansburg (not V. of Dryden). until Monday's vote, the Trumansburg Central School District was the only school district in the County to offer a veterans exemption ($12,000/$20,000/$40,000).

Monday's vote was prompted by a request 13 months ago by retired career military medevac pilot Bill Howard, now a Lansing resident, when petitioned the Board of Education to adopt an exemption. Howard argued that service men and women not only make sacrifices to protect the country, but their families experience hardship and stress as well. That prompted a year of discussion and public discourse with regular updates to the Board on the impact to the school district and non-veteran residents.

There is no dollar impact to the school district. When district voters approve a budget each May they are simply authorizing the school district to spend an amount of money. While it is very early in the 2018-19 budget development process, School Business Administrator Kate Heath estimates that next school year's budget will be $29,996,822, At this stage $18.8 million of that would be raised in property taxes with another $1.03 million in Payment In Lieu Of taxes (PILOT) revenues that are contracts between developers and Tompkins County to pre-set the valuation of their businesses over a period of time, usually in order to provide incentives for businesses to build in the area.

"Based on what I'm looking at today we'll be looking at a tax rate of $20.90, which would be a 1% increase over this year's rate," Heath said. "This year it was $20.72 per $1000 (of assessed value). It would be $4,180 for a $200,000 home."

The exemption would impact that $18.8 million that is raised in property taxes. When one group of people get to pay less, the rest have to pay more to make up that amount. Heath said that assessed taxable value lost at the $6,000/$10,000/$20,000 exemption level would be $2,099,700, shifting $43,497 from veterans to non-veterans. That would raise the tax rate for non-veterans by 5 cents per thousand dollars worth of assessed value, shifting the 2018-19 tax rate from $20.72 to $20.77 for a $200,000 home.

"I've heard you talk about the 'burden' being transitioned over to the non-veterans families," Howard said Monday. "I would just like to say there is a tremendous burden men and women in uniforms and their families undergo. When you go to vote tonight. I know there's a lot of patriotism in the country. But this is your opportunity to impact 207 veterans in your community and their families with this small token of your appreciation."

County legislator Mike Sigler (Lansing) said his own taxes would rise around $15 to $20, a trade-off he was glad to make when it came to helping former service men and women who put their lives on the line.

"The County already does this. A lot of towns already do this. When I was 18 years old I tried to become part of the military. I was either too dumb for one branch, or my eyesight was too bad for the other. I don't feel I really had skin in the game when it came to defending the country. I think that is what this is about. I look at the veterans that are moving into our community and they're a real benefit to us. They put skin in the game defending the country."

Superintendent Chris Pettograsso said the Lansing School Board had considered the exemption before, when severe reductions to the Cayuga Power Plant assessment made school finances so challenging.

"Lansing had talked about it previously, and it was a conscious choice not to implement it, because we were losing revenue, significantly from the power plant," she said. "It's not just this. It's the whole budgetary package and how much taxes would increase on the other end. It was a bad time for Lansing to move forward with this, and I think it was a tough time financially for a lot of other school districts as well. Now it's coming up more."

When it came to a vote the measure passed with Tony Lombardo, Brenda Zavaski, Susan Tabrizi, and Aaron Thompson voting in favor of the exemption, and Aziza Benson, and Julie Boles voting no.

I understand there are people who are also struggling with taxes, but $10 bucks, $15 bucks a year for them is less than two dollars a month," Thompson said.

v14i7