- By New York State Governor's Office

- News

Print

Print

Governor Andrew M. Cuomo was joined Sunday by the full delegation of Long Island Senators for a rally at Clinton G. Martin Park in New Hyde Park in support of the Governor's campaign to make the 2% property tax cap permanent. Earlier this month, the Governor vowed that he will not sign a budget without the permanent property tax included while outlining his remaining budget priorities.

"Washington's tax plan took care of the rich, but cast the burden on states like New York and did nothing for the middle class," Cuomo said. "In this budget we are taking action so we can say to the middle class, we hear you, we know your pain, we know you're struggling, and this hand will not sign a budget that does not have a permanent tax cap, period."

In 2011, Cuomo vowed to bring property taxes under control once and for all. After years of trying to cap property taxes, New York passed the first ever 2% property tax cap. Since the implementation of the tax cap in 2012, local property tax growth has averaged 1.9%, compared to 5.3% average growth from 2000 to 2010, and the tax cap has produced approximately $8.7 billion in taxpayer savings on Long Island and $24.4 billion statewide. The property tax cap has changed long-term trends and the trajectory of the state.

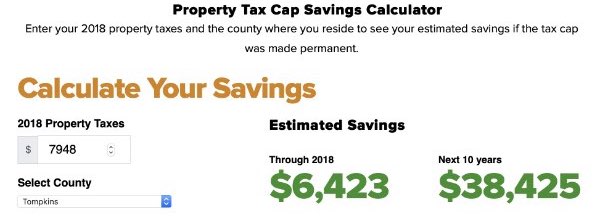

To illustrate the benefits of a permanent property tax cap, Governor Cuomo unveiled a digital tax calculator to showcase estimates of how much taxpayers have saved under the property tax cap and will continue to save over the next 10 years with a permanent property tax cap.

v14i12