- By Dan Veaner

- News

Print

Print

While the Town of Lansing continues to craft its local law to amend the Land Use Ordinance relating to solar and wind energy systems, the main issues that have arisen are protection of Lansing's prime farm land, and how tax exemptions or PILOTs (Payment In Lieu Of Taxes) might impact revenues to the town and other local taxing authorities. Tompkins County Director of Assessment Jay Franklin was at last week's Town Board meeting to address tax exemptions, and Lansing Agriculture Committee Chair Connie Wilcox spoke to the impact on local farmers.

"I can't stress enough that people need to understand that the food doesn't appear on your table from waiting in the checkout line," Wilcox said. "Even for vegetarians and vegans the food has to come from someplace. And your farmers are the ones that are providing it. We're getting fewer and fewer farms in New York State all the time. So we have to be very judicious with how we treat that land and what we do."

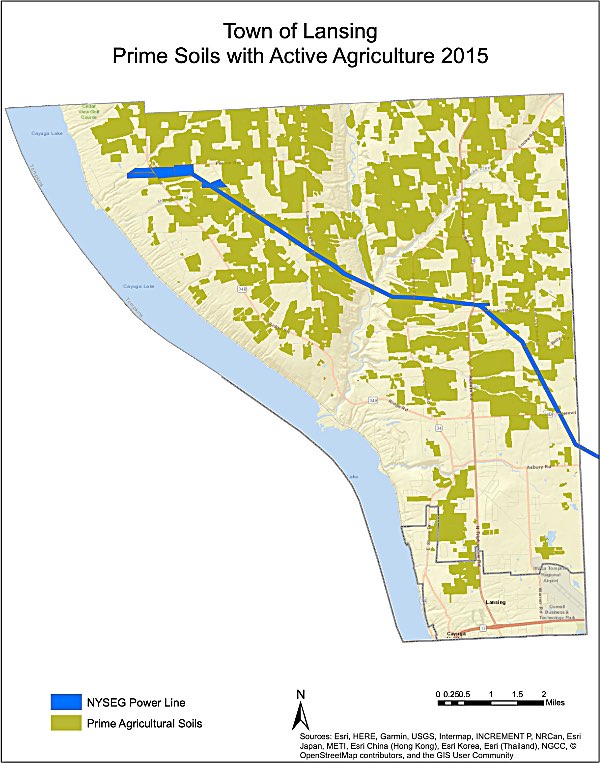

Power lines cut through the Town of Lansing from the location of the now shuttered Cayuga Power Plant in the northwest of the Town to the Lansing/Dryden border. The best location for solar farms is within a half mile of those power lines because, obviously if you want to hook up your power generating solar array to the NYSEG grid it is a lot less expensive to do so if your array is next to a grid location. Those power lines were installed for the power plant to supply electricity to the grid, which makes them ideal for large solar farms. But that land is also the location of many farms with prime soil for growing crops.

Farming is a multi-million dollar Lansing industry. A few years ago Cornell Cooperative Extension Agriculture Program Leader Monika Roth told Lansing officials that Lansing farms generate almost one-third of the $67 million total farm product sales in the Tompkins County, providing at least 40 full time jobs for owners and operators and at least 60 part-time or seasonal jobs, with a combined payroll of at least $3 million. There are 8,472 acres of Lansing farmland farmed by owners, and an additional 8,570 acres leased. The town has some of the best prime farm land in the county. So concerns about preserving it for farming are not insignificant.

Franklin told the Town Board last week that a state law provides an exemption or solar, wind farm energy and "about 38 other things that the state keeps adding every year".

"This is kind of an odd exemption," Franklin explained. "All municipalities are already in it unless you decide to opt out of them. Typically you have to vote to granted, but this was the one that you had to vote to opt out. And again, this is a very poorly written exemption because one, it doesn't allow you to make any distinction between solar panels on somebody's house and a hundred megawatt solar array that's generating electricity to the grid. So it doesn't make that residential industrial distinction you're either in or you're out for all of it."

Franklin said that municipalities must opt in or out of the law that covers both residential roof solar panels and large industrial solar farms. But he explained that opting out of the exemption does not currently impact homeowners with solar panels on their roof or in their yard because for assessment purposes solar doesn't add much, if any value to a home's tax assessment.

"As of right now we're not seeing solar panels on a house adding value to that house," he said. "At some point in the future it may, but we're not seeing that now. And there may be some value in there, but if we're looking at an average sale of $250,000 and with the incentives of putting solar $250 and $252 thousand is essentially the same."

If the Town opts into the exemption Franklin said it is likely solar farm developers would negotiate a PILOT, which is favorable to the developer in pre-setting agreed-upon assessments.

"Now when you're looking at an industrial two megawatt, five megawatt, a hundred megawatt development, yes," Franklins said. "There is money to that. It's not nearly as much as what they're building those properties for, you know, if you have a 2 million watt or a two megawatt project, it probably is going to cost somewhere between four to five million to build the value that we're seeing in year one. It's about a million dollars per megawatt. Now, if this was a utility generator and selling it directly to the grid, that value is probably going to be cut in half."

Lansing Director of Planning C.J. Randall added that while industrial solar farm companies negotiate PILOTs, they may also negotiate to pay a fee to the Town.

"One of the issues surrounding utilities-scale solar -- projects that are larger than 25 megawatts in size... This is how they're classified just for ease of how the public service commission sees them. Those types of projects typically are looking to do a PILOT, but concurrently a host community agreement, which is a direct payment to the town on a per megawatt basis for the pleasure of hosting that project," Randall said.

Wilcox reported that the latest Agriculture Committee meeting was largely taken up by a presentation by a solar company that may want to lease farmland for large arrays.

"That's a really difficult thing to do because most of the large farm areas that would have that kind of acreage are not looking to put in any solar arrays," Wilcox said. "They're looking to keep it as farm land. I know some of the smaller farmers are looking at leasing some of their land out because it's, it's money for them."

Wilcox also said she has doubts that the income would actually materialize.

"They're offering a good amount of money at this point in time, but will that really come to fruition?," she cautioned. "I know it's not the same thing, but is similar to the gas leases. When they went around to all the farmers and they signed him up for all the gas leases and that money all just went away. They might've gotten one check for maybe a couple of thousand dollars and after that it was gone."

A draft of the solar and wind law is posted on the Town Web Site. Randall says that one of the most significant ongoing issues in developing the law is how many contiguous acres of farmland should be allowed for large solar projects.

Franklin told the Board that if they do decide to opt into a solar tax exemption it wouldn't go into effect until the next taxing year if the town opts in or out by March 1st.

v16i9