- By Dan Veaner

- News

Print

Print

Valeria Coggin (left) explains changes in property tax assessment procedure while Village Trustees Larry Fresinski and Lynn Leopold listen

While changes in property values do go up and down, valuing property at its full value won't have much, if any, effect at all, because the amount of property taxes we pay is relative to the portion everyone else in the county pays. So if your valuation goes up 15% and your neighbor's also goes up 15% the portion of the tax burden is the same as it was when your properties were both valued at 85% of their market value.

"What it comes down to is that equity is what is important," explains Tompkins County Department of Assessment Valeria Coggin. "We can assess you at a fraction of the value as long as it is an equal percentage of value for each and every parcel."

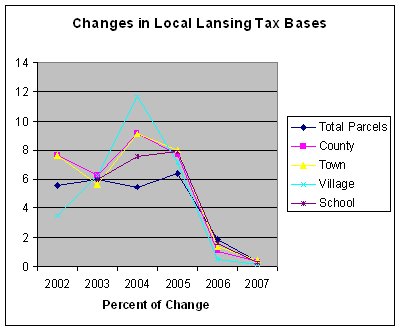

In Lansing the tax base is flattening, so its effect on the taxes you pay diminishes. That makes your assessment and the tax levy more significant in determining whether your taxes rise or fall.

| Property Tax Primer Budget: The full amount a municipality sets out to raise from various sources, including property taxes, for a given year. Tax Levy: The part of the budget that must be raised by taxes. Other parts of the budget might be raised by fees, state aid, grants, by using reserves of funds collected in past years, and so on. Assessment: A dollar figure assigned to your property. Tax Base: The total value of properties contributing to the tax levy. Tax Rate: The amount you pay per $1000 of your property's assessed value. Your actual tax is calculated by multiplying the tax rate times the number of thousands of dollars your property is assessed at. If the tax rate is 15 cents and your house is valued at $100,000 then your tax amount will be (0.15x100) $15. How it all comes together: Individual taxpayers are responsible for a small percentage of the total tax levy. The amount of your assessment determines what that percentage will be relative to all the other property owners within the boundaries of a particular taxing authority (such as your town, county, school district, etc.) As the tax base grows individuals pay less, because more taxpayers are sharing the burden. So even if your assessment goes up you may pay less in taxes depending on how much higher the levy is than last year, how many new properties have entered the tax roles. | ||

The problem Coggin's department faces is that there are so many factors affecting your final tax bill that few people really understand how the amount you pay is arrived at. The value of your property is only one of the factors, and there are may elements that factor into determining that alone, including the last sale price, the value of neighboring homes, the location, aerial photography showing things like swimming pools and landscaping, the size of your house and its condition.

Well, that's one of the problems. The most common problem is when property owners disagree with their assessments and the way they are arrived at. At Monday's meeting Trustee Frank Moore took Coggin to task for placing the burden of proof on the taxpayer. But she pointed out that the law places that burden on the taxpayer, and that it makes more sense for a property owner who is familiar with his property to make the corrections than it does for her department to do it for all 34,500 parcels in the county.

Coggin also noted that her department doesn't always have accurate information to base their assessment on, and that it can be very hard to get it. "People don't really open their doors wide for us," she laments. "Therefore we use the information that we have available in our office. If our data is incorrect and we based your value on that incorrect data, you have to write to us or tell us to correct that."

The Assessment Office receives about 8,000 challenges per year, but Coggin says that they have no interest in over or undervaluing your property. Ultimately your tax bill is determined by the fraction of a percentage of the total tax levy that you are responsible for. That is based on your real estate value as compared to everyone else's. But the total amount raise by taxes remains the same, so there is no reason for the County to overvalue properties.

Another factor is the number of people contributing. The more new homes there are, the less everyone has to pay, because more people are now helping to pay that levy, an amount fixed by municipalities when they approve their budgets. So while a higher valuation could make your taxes go higher, they could also go lower if more people join the mix, or if the levy stays the same or is reduced.

If that isn't confusing enough, the 'sticker shock' Coggin refers to will be hard to avert. Even though 100% of $1000 is the same proportionally as 85% when everyone's assessment is calculated at the same percentage of market value, it just looks like more. It actually makes more sense to value property at 100%, because it simplifies the staggeringly complicated math.

| Your Assessment on the Web Is It Accurate? When I learned that all the assessment data is on the Internet I went to the Tompkins County Assessment Department Web site and looked up my own house. Most of what I found was as expected. Some changes had not been recorded, even though we went through the Town codes office and got all the proper permits when we made them. There were some contradictions in the data, though I don't think they would affect our assessment very much. For example a search on our house showed a third again more living area in square feet than our listing in the comparables search did. However it rightly compared our home to houses that have about the same actual sqaure footage as ours does. The single home search also revealed that we live in a Colonial style house. We don't. But the search of comparable properties listed our house as 'contemporary' style, which is more accurate. All the properties our house was compared to are Colonials, and three out of four were built within the past few years. Our house was built in 1977, and the fourth comparable in 1973. Most interesting to me was the last recorded sale prices. We bought our house 13 years ago. All four comparables were sold within the past two years. The lowest priced sale was a good $212,000 more than what we paid. The highest was $372,000 more. I could take this a few different ways. First, if I were to sell my house today that could be good news. Clearly property values have risen. But our house is on a rural street, a bit far out compared to the other four, which are in more posh neighborhoods. So I don't really think we'd make that $372,000 profit if we wanted to sell. | ||

Coggin noted that three quarters of the states currently assess at 100%. She added that New York State wants counties to use a unified system of 100% assessment. "If we do a good job, it provides the County $154,000 from the State," she noted. "The State rewards assessing units who assess at 1000% of the market value. The last two years we lost over $300,000. And who picks it up? You and I."

While the percentage of the value of your house the County uses is only a perceived rise, the accumulated three year assessment is potentially three or more times the jump in value that homeowners experienced when reassessment was done every year. In most places in the United States that would seem advantageous, because of sinking real estate markets. But Tompkins is the little county that could. "Despite what you hear in the media that real estate prices are dropping everywhere, Tompkins County is an oasis," Coggin says. "Our real estate is very stable. Prices are still considerably higher than the assessment."

Coggin says she plans to recommend that the Legislature go back to a one year cycle once all the all 34,500 taxable parcels are brought up to full value this year.

Meanwhile her department has produced a booklet that answers the most frequently asked questions about tax assessments. The booklet will be available at Town and Village halls, as well as on the department's Web site. A condensed version of the booklet will be mailed to all taxpayers alone with the tax impact notices that will be mailed starting January 25th. After that County assessors will schedule informal hearings at which taxpayers will have the opportunity to update the department's data on their properties with an eye toward possibly reducing the valuation. Coggin says you can schedule a hearing in person or on the Web site, and that either method receives the same consideration in her office.

Coggin says you can't blame the Assessment Office for higher taxes, because they simply try to attach a fair assessment to each property. And she notes that it is the municipalities that set budgets higher or lower. "You can't complain about income tax or sales tax," Coggin says. "The only tax you can complain about is property tax. A lot of times people are really upset when they come in to complain. But once they sit down with an appraiser and they really understand that their property is worth that much, they say, 'I don't like what I hear, but at least I understand what you are saying.'"

The bottom line, she says, is that there shouldn't be a significant change in the bottom line for most people, other than the natural fluctuations that occur as markets and budgets rise and fall. That means that some people will see higher or lower than 15% rises in their assessment, depending on how values in their neighborhoods have risen or fallen. But she says that most people will see about a 15% rise, and the fact that all properties are assessed at the same level should not, by itself, mean a difference in the dollar amount of taxes you pay.

"In general in the Village of Lansing there shouldn't be any increase in your taxes other than the normal increments that happen every year," she said. "It's not going to be because of the increase in your assessment unless your property increased at a higher rate than average."

----

v4i2