- By Dan Veaner

- Opinions

Print

Print  Tuesday was Tax Freedom Day in New York State this week. Tax Freedom Day is the point in the year when you have earned enough to pay all your taxes for the year. So in New York you had to work four months and six days before you started earning for yourself and your family. According to a report by Bloomberg, New York is the 9th most taxing state out of 51 (the 50 states and the District Of Columbia). Surprise! I thought we'd be #2, after California. Still 9th isn't good.

Tuesday was Tax Freedom Day in New York State this week. Tax Freedom Day is the point in the year when you have earned enough to pay all your taxes for the year. So in New York you had to work four months and six days before you started earning for yourself and your family. According to a report by Bloomberg, New York is the 9th most taxing state out of 51 (the 50 states and the District Of Columbia). Surprise! I thought we'd be #2, after California. Still 9th isn't good.I grew up in Massachusetts, which we called 'Taxachusetts' in those days. When my father retired he was looking for states to move to that had more favorable taxes, since he would not be earning any more. I remember at that time it was between New Hampshire and Florida. Sunshine won out. Then his idiot son moved to New York State.

In this year's data from the Tax Foundation (click here to download their 2014 Facts & Figures booklet), which describes itself as a non-partisan research think tank based in Washington, DC., New York collects more individual income tax per person than any other state. But the new budget will provide a break for some property taxpayers. For example if the Lansing school budget is passed in next week's vote Lansing school taxpayers will get a rebate in the amount of the rise in school taxes from last year because school officials crafted a budget that falls below the so-called 2% tax cap figure (which is actually over 4%, but who said math in New York ever made sense?)

However, a new estate tax law is going to mean a nasty surprise for some New Yorkers when they find that portions of their estates might be taxes at a tax rate of 164%. The estate would have to be worth over $2 million, so that won't hit all of us. Still, even the most extreme liberals should see that a tax that is more than 100% is ridiculous. Like many new laws and mandates in New York State the new estate tax is billed as one thing and actually turns out to be something else. It's public relations is that it's a break for estate taxpayers. Another example? How about that 2% tax cap that in Lansing is 4.1% this year and could be overridden if 60% of Lansing voters chose to pay more?

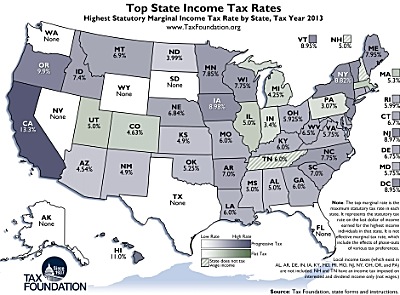

Darker is higher taxes, lighter is lower. Map courtesy of the Tax Foundation (click map for original page and larger map)

Darker is higher taxes, lighter is lower. Map courtesy of the Tax Foundation (click map for original page and larger map)Still, we rank the 9th most overall-taxed state after (from highest to lowest) California, Hawaii, Oregon, Minnesota, Iowa, New Jersey, Vermont and Washington, D.C.. Maine is number ten.

Looking for some relief? You don't have to go far. Pennsylvania ranked as the lowest overall taxed state in the nation. And what happened to Taxachusetts? It is somewhere in the middle.

New York ranks #1 in state income tax burden. On a scale of 1 to 50 where 1 is the most favorable for business and 50 is least, New York ranked 50th as of July 1, 2013. Our state was #11 in 2012 for the most federal aid received. So even though we're getting all that federal money, we still pay more than anyone else. And New York ranks as the 4th highest property taxed state.

Surprisingly, since January 1st of this year New York ranked 38th in the amount of sales taxes collected. Much less surprisingly, New York was #2 in gasoline tax so far this year (only California collects more). 56.5% of expenses for state and local roads came from tolls, user fees and user taxes, with New York ranking #11 for funding the highest percent of roadwork with those items. If you view that as an additional tax, at least it's a progressive tax, making the people who use the roads pay for just over half of the expense of them.

New York ranks 41 in state wine taxes (dollars per gallon - only 30 cents in New York) and 39 in state beer taxes (a mere 14 cents per gallon). Very low compared to Kentucky, which takes $3.56 per gallon in wine tax and Tennessee, which collects $1.17 per gallon in beer tax.

What this means to me is that the people in Albany know that they are taxing us into the ground and evidently intend to keep doing it. But they want to encourage us to drink ourselves silly so it won't sting as much.

Happy Tax Freedom Day!

v10i17