- By New York State Comptroller's Office

- Business & Technology

Print

Print

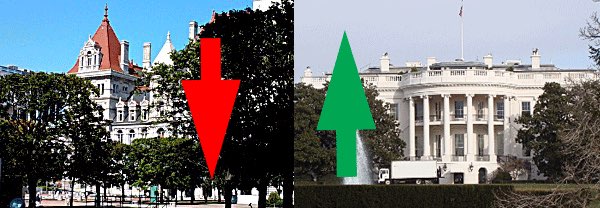

New York sent an estimated $24.1 billion more in tax payments to Washington than it got back in federal spending in federal fiscal year (FFY) 2017, getting back 90 cents for every dollar, according to a reportreleased today by State Comptroller Thomas P. DiNapoli. In 2017, New York was one of just 11 states that sent more to Washington than it received. Only New Jersey, Massachusetts and Connecticut fared worse while New Mexico fared the best.

"New York gives more than it gets back from Washington and threats to cut federal funding for health care and other programs could tip the balance even further," DiNapoli said. "The state relies on the federal government for a third of its annual budget, but the imbalance of tax dollars remains. New Yorkers deserve to be treated more fairly in the federal budget."

DiNapoli's report, a follow-up to analyses released in 2015 and 2017, shows federal spending in New York during FFY 2017 totaled $225.7 billion while the state sent Washington nearly $250 billion. Federal spending in New York included $140.5 billion in direct payments for individuals through programs such asSocial Security and Medicare; $66.5 billion in grants; $11 billion in procurements; and $7.4 billion in wages and salaries.

While New York received 10 cents less per dollar of taxes, most states received more than they paid. The average return for all states was $1.19 per tax dollar sent to Washington. New York's per capita contribution to the federal treasury, $12,588, was the fourth highest among the states. Connecticut had the highest per capita payments to the federal government at $14,671, followed by Massachusetts with $13,675 and New Jersey with $12,970. Mississippi generated the lowest per capita total tax payments at $5,884. New York's total payments of nearly $250 billion ranked third among the states behind California and Texas.

New York's balance of payments with Washington varies from year to year, but has remained consistently negative in each of the three federal fiscal years analyzed by DiNapoli. In FFY 2016, the state received 84 cents for every dollar it sent in taxes to the federal government,and in FFY 2013, 91 cents.

New York's balance of payments improved from 2016 to 2017 because of a variety of factors. In FFY 2017, federal spending rose more rapidly than federal receipts. In New York, federal spending grew more than in the nation overall, 5.4 percent compared to 3.7 percent,due in part to increased funding for Medicaid and other health care programs provided by the Affordable Care Act.

Overall, New York state received 6 percent of total federal spending examined. The state generated 8 percent of $3.1 trillion in total federal tax revenue examined, which was higher than its shares of the U.S. population (6.1 percent) and of the nation's personal income (7.4 percent). On a per capita basis, federal tax revenues from New York state were more than 30 percent higher than the national average.

DiNapoli’s report notes:

- Half of the $3.1 trillion in federal revenues came from individual income taxes. New York’s per capita individual income tax payments of $6,986 were 44 percent higher than the national average of $4,847. New York ranked fourth among the states in this category, with Connecticut first at $8,473.

- New York’s contribution for social insurance taxes, including those for Social Security and unemployment insurance, at $4,094 per capita, was 15.5 percent above the national average of $3,543, ranking it 10th among all states.

- Corporate income taxes made up 9.5 percent of total federal tax receipts in FFY 2017. Per capita corporate income taxes for New York were $1,213, $301 higher than the national level of $912, placing New York third among the states.

- On the spending side, direct payments to or for individuals, such as Medicare and Social Security, accounted for the largest component of federal government expenditures in 2017 – 62.6 percent. New York’s $140.5 billion in these payments accounted for 6 percent of the nationwide total, ranking it fourth highest for direct payments behind California, Florida and Texas. New York’stotal included approximately $56.7 billion in Social Security payments and almost $48 billion for Medicare.

- Federal grants to state and local governments totaled $669 billion in 2017, with Medicaid, the largest of these programs, at 55.7 percent of the total.New York ranked second among the states, at $3,350 per capita, 63 percent above the national average, largely because of Medicaid, and other safety net grants. Federal aid makes up more than a third of New York’s current state budget.

- The federal government spent $473.7 billion in FFY 2017 for procurement in the 50 states and Washington, D.C. The Department of Defense was the source of 63 percent of such spending. With $574 in per-capita procurement spending, about 40 percent of the national average, New York ranked 41st among the states. Defense spending was $307 per person in New York, compared to a national average of $916.

- Spending on federal employee wages and salaries throughout the nation totaled $256.7 billion. New York’s share was slightly less than 3 percent of the national total. This included $5.1 billion for civilian pay ($258 per capita) and $2.2 billion for military pay ($113 per capita). Overall, per capita expenditures in New York for wages and salaries, $371, were almost 53 percent below the national level and ranked New York 42nd among all states.

v14i40