- By New York State Comptroller's Office

- Business & Technology

Print

Print

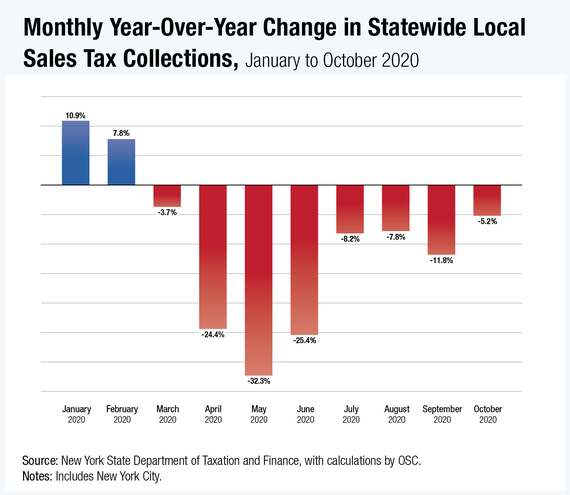

Local government sales tax revenue declined by 5.2 percent in October compared to the same month last year, according to State Comptroller Thomas P. DiNapoli. October's sales tax collections totaled $1.4 billion for counties and cities, or $74.4 million less than in October 2019.

This drop was less severe than previous declines since the start of the COVID-19 pandemic, particularly in the spring when collections fell by double-digits. Still, declines in local sales tax collections continue to mount, and overall local government collections in 2020 (January-October) are down nearly $1.6 billion (10.4 percent) compared to the same period in 2019.

"Statewide local sales tax collections have declined year-over-year for eight straight months," DiNapoli said. "Our local governments are on the forefront of the pandemic response and they need financial aid from the federal government to help them get through this crisis."

New York City had a 5.3 percent, or $34.5 million, decline in sales tax revenue in October, and all but eight counties in the state saw drops in collections as well, ranging from 0.8 percent in Jefferson and Rockland counties to nearly 19 percent in Oswego and Monroe counties. On a regional basis, sales tax collections were down across the board, ranging from a decline of 2 percent in the North Country to a drop of 13.5 percent in the Finger Lakes.

DiNapoli reported last month that local sales tax collections dropped 9.5 percent in the July-September quarter, down $452 million from collections in the same quarter of 2019.

v16i45