- By New York State Governor's Office

- News

Print

Print

Governor Andrew M. Cuomo announced Tuesday that the State Department of Labor is issuing an order eliminating the subminimum wage for 'miscellaneous' industries statewide. The order impacts over 70,000 tipped employees and will end confusion and outright wage theft that evidence shows robs them of tipped income they rightfully earned. Workers that will be impacted by the new measure include: nail salon workers, hairdressers, aestheticians, car wash workers, valet parking attendants, door-persons, tow truck drivers, dog groomers and tour guides.

"In New York, we believe in a fair day's pay for a fair day's work," Cuomo said. "But after an exhaustive investigation conducted by the Department of Labor, it's clear the tip system in many situations is needlessly complicated, allowing unscrupulous businesses to flout our nation-leading minimum wage laws and robbing workers of the paycheck they earned. That ends now. Today, I am directing the labor department to put an end to the tip credit in the industries with the highest risk of wage theft to help restore fairness for workers, many of whom are critical to the service industries that keep our economy moving forward."

The elimination of the tip wage for miscellaneous industries will be phased in over a one-year period, an aggressive timetable that will provide employees relief while also giving businesses time to adjust to these changes as to not inadvertently incur job loss.

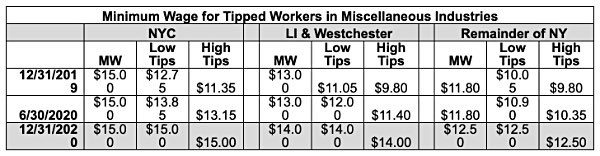

The schedule includes:

- On June 30, 2020, the difference between the minimum wage and current tip wages will be cut in half.

- On December 31, 2020 the tip wage will be completely eliminated and workers in these effected industries will be making the normal minimum wage.

The ending the State's tip credit for miscellaneous industries -- bringing those workers up to the current minimum wage -- comes as the Department of Labor released a report and recommendations after conducting hearings and receiving testimony from individuals across tipped industries.

Key findings in the DOL report note that:

- The current system of tipping disproportionally impacts the lowest-paid workers in our state: women, minorities and immigrants.

- Miscellaneous workers receive less in tips and have widespread confusion about whether or not they are entitled to earn minimum wage or not. This has led to rampant wage theft in particular industries, and a real concern that tip credits are simply not appropriate in others, as many of their customers aren't clear that tips are expected.

New York State Law allows certain industries to pay tipped employees below the state minimum wage only if those employees earn enough in tips to make up the difference. In certain workplaces where wages and tips are both generally low, workers' income can rely almost entirely upon tips.

The industries affected by today's action were grouped together in a category known as 'miscellaneous' more than 30 years ago creating the unintended consequence of establishing a tip credit in various industries where the tip credit had previously been prohibited.

In practice, many employers in these industries find it difficult to keep track of employee tips properly, as they are not a steady and reliable source of income that can be depended upon by workers to meet their living expenses. Additionally, daily and weekly fluctuations make it difficult for workers to know whether they are being underpaid and complicated tip credit record keeping can make it difficult for employers to know whether they are meeting their obligations.

Through testimony and investigations by DOL, patterns emerged suggesting that these industries were prone to bad practices that resulted in tips not always making their way into workers' hands and were more vulnerable to wage theft schemes. A three year assessment of wage theft cases investigated by the Department of Labor published in 2018 show that nearly two-thirds of all minimum wage-related cases were in the industries covering miscellaneous industry workers, and in 80 percent of cases, underpayments were found.

A Department of Labor investigation in 2008 found that nearly eight out of every 10 car washes in New York City and one out of two across the state violate minimum wage and overtime laws, with some paying just $3 an hour. Investigators visited 84 carwashes throughout the state and uncovered $6.5 million in underpayments to 1,380 workers.

$15 Minimum Wage Phase-In and Economic Parity in New York State

Since he first took office, Cuomo has worked to restore economic parity and social justice to working families in New York State, including passing a $15 minimum wage to restore economic fairness, enacting the nation's strongest job-protected paid family leave program and extending protections to public sector employees in local and state government following the devastating "Janus" Supreme Court decision. This year, the Governor continued this historic progress by enacting the Farm Workers Bill, giving thousands of farm workers in New York the right to collectively bargain and other crucial protections.

The $15 minimum wage will be fully phased in for New York City as of December 31, 2019, and is continuing to reach $15 in Long Island, Westchester and the rest of New York. The legislation was passed as part of the 2016-17 state budget, and marked a major accomplishment in the Governor's efforts to restore economic justice and fairness to working families in New York State.

The phase-in schedule on a regional basis is as follows:

- For workers in New York City employed by large businesses (those with at least 11 employees), the minimum wage rose to $11 at the end of 2016, then another $2 each year after, reaching $15 on 12/31/2018.

- For workers in New York City employed by small businesses (those with 10 employees or fewer), the minimum wage rises to $15 on 12/31/2019.

- For workers in Nassau, Suffolk and Westchester Counties, the minimum wage increased to $10 at the end of 2016, then $1 each year after, reaching $13 on 12/31/2019.

- For workers in the rest of the state, the minimum wage increased to $9.70 at the end of 2016, then another .70 each year after, rising to $11.80 on 12/31/19.

v16i1